2018 Year-End Tax Planning Tips

Tuesday, October 30, 2018 at 8:02PM

Tuesday, October 30, 2018 at 8:02PM Yep, it's that time of year again. While the stock markets were busy correcting in October, making for a very volatile month, our thoughts turn to year-end tax planning.

Now is the time to take steps to cut your 2018 tax bill. Here are some relatively foolproof year-end tax planning strategies to consider, taking into account changes included in the Tax Cuts and Jobs Act (TCJA).

Year-end Planning Moves for Individuals

Game the Increased Standard Deduction Allowances. The TCJA almost doubled the standard deduction amounts. For 2018, the amounts are $12,000 for singles and those who use married filing separate status (up from $6,350 for 2017), $24,000 for married joint filing couples (up from $12,700), and $18,000 for heads of household (up from $9,350). If your total annual itemizable deductions for 2018 will be close to your standard deduction amount, consider making additional expenditures before year-end to exceed your standard deduction. That will lower this year’s tax bill. Next year, you can claim the standard deduction, which will be increased a bit to account for inflation.

The easiest deductible expense to accelerate is your home mortgage payment due on January 1. Accelerating that payment into this year will give you 13 months’ worth of interest deductions in 2018. Although the TCJA put new limits on itemized deductions for home mortgage interest, you are most likely unaffected (mostly affects some interest on home equity loans and lines of credit).

Also, consider state and local income and property taxes that are due early next year. Prepaying those bills before year-end can decrease your 2018 federal income tax bill because your itemized deductions will be that much higher. However, the TCJA decreased the maximum annual amount you can deduct for state and local taxes to $10,000 ($5,000 if you use married filing separate status). So, beware of this new limitation, and don't be in a hurry to pre-pay property taxes by year-end if there's a better chance that you might be able to deduct them in 2019.

Accelerating other expenditures could cause your itemized deductions to exceed your standard deduction in 2018. For example, consider making bigger charitable donations this year and smaller contributions next year to compensate. Be sure to ask us about a donor advised fund, which can accelerate donation deductions this year, while taking your time (perhaps years) to "grant" amounts to your favorite charities. Also, consider accelerating elective medical procedures, dental work, and vision care. For 2018, medical expenses are deductible to the extent they exceed 7.5% of Adjusted Gross Income (AGI), assuming you itemize.

Warning: The state and local tax prepayment drill can be a bad idea if you owe Alternative Minimum Tax (AMT) for this year. That’s because write-offs for state and local income and property taxes are completely disallowed under the AMT rules. Therefore, prepaying those expenses may do little or no good if you are an AMT victim. While changes in the tax law reduced the number of people subject to the AMT, you may want to contact us if you are unsure about your exposure to the AMT.

Carefully Manage Investment Gains and Losses in Taxable Accounts. If you hold investments in taxable brokerage firm accounts, consider the tax advantage of selling appreciated securities that have been held for over 12 months. The maximum federal income tax rate on long-term capital gains recognized in 2018 is only 15% for most folks, although it can reach a maximum of 20% at higher income levels. The 3.8% Net Investment Income Tax (NIIT) also can apply at higher income levels.

To the extent that you have capital losses that were recognized earlier this year, or capital loss carryovers from pre-2018 years, selling winners this year will not result in any tax hit. In particular, sheltering net short-term capital gains with capital losses is a sweet deal because net short-term gains would otherwise be taxed at higher ordinary income rates.

What if you have some loser investments that you would like to unload? Biting the bullet and taking the resulting capital losses this year would shelter capital gains, including high-taxed short-term gains, from other sales this year.

If selling a bunch of losers would cause your capital losses to exceed your capital gains, the result would be what's known as a net capital loss for the year. No problem! That net capital loss can be used to shelter up to $3,000 of 2018 ordinary income from salaries, bonuses, self-employment income, interest income, royalties, and whatever else ($1,500 if you use married filing separate status). Any excess net capital loss from this year is carried forward to next year and beyond.

In fact, having a capital loss carryover into next year could turn out to be a pretty good deal. The carryover can be used to shelter both short-term and long-term gains recognized next year and beyond. This can give you extra investing flexibility in those years because you won’t have to hold appreciated securities for over a year to get a preferential tax rate. Since the top two federal rates on net short-term capital gains recognized in 2019 and beyond are 35% and 37% (plus the 3.8% NIIT, if applicable), having a capital loss carryover into next year to shelter short-term gains recognized next year and beyond could be a very good thing.

One thing to keep in mind when either "harvesting" losses or holding on to winners to avoid capital gains: don't let the tax "tail" wag the investment "dog". Selling a loser for the sake of recognizing tax losses may not be prudent if the investment is temporarily undervalued. Conversely, holding onto an investment just to avoid capital gains taxes or to enjoy long term capital gains treatment may cost you more in lost gains than the taxes you'll save. Be smart about it.

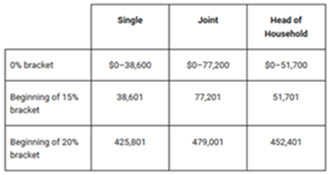

Take Advantage of 0% Tax Rate on Investment Income. The TCJA retained the 0%, 15%, and 20% rates on Long-term Capital Gains (LTCGs) and qualified dividends recognized by individual taxpayers. However, for 2018–2025, these rates have their own brackets that are not tied to the ordinary income brackets. Here are the brackets for 2018:

Note: The 3.8% NIIT can hit LTCGs and dividends recognized by higher-income individuals. This means that many folks will actually pay 18.8% (15% + 3.8% for the NIIT) and 23.8% (20% + 3.8%) on their 2018 LTCGs and dividends.

While your income may be too high to benefit from the 0% rate, you may have children, grandchildren, or other loved ones who will be in the 0% bracket. If you're planning to give them cash, alternatively consider giving them appreciated stock or mutual fund shares that they can sell and pay 0% tax on the resulting long-term gains. Gains will be long-term as long as your ownership period plus the gift recipient’s ownership period (before the sale) equals at least a year and a day.

Giving away stocks that pay dividends is another tax-smart idea. As long as the dividends fall within the gift recipient’s 0% rate bracket, they will be federal-income-tax-free.

Warning: If you give securities to someone who is under age 24, the Kiddie Tax rules could potentially cause some of the resulting capital gains and dividends to be taxed at the higher rates that apply to trusts and estates. That would defeat the purpose. Please contact us if you have questions about the Kiddie Tax and refer to our post on the topic: Is Tax Simplification Just A Kiddie’s Play?

Also, one can be doing pretty well income-wise and still be within the 0% rate bracket for LTCGs and qualified dividends. Consider the following examples:

· Your married adult daughter files jointly and claims the $24,000 standard deduction for 2018. She could have up to $101,200 of AGI (including LTCGs and dividends) and still be within the 0% rate bracket. Her taxable income would be $77,200, which is the top of the 0% bracket for joint filers.

· Your divorced son uses head of household filing status and claims the $18,000 standard deduction for 2018. He could have up to $69,700 of AGI (including LTCGs and dividends) and still be within the 0% rate bracket. His taxable income would be $51,700, which is the top of the 0% bracket for heads of household.

· Your single daughter claims the $12,000 standard deduction for 2018. She could have up to $50,600 of AGI (including LTCGs and dividends) and still be within the 0% rate bracket. Her taxable income would be $38,600, which is the top of the 0% bracket for singles.

Give Away Winning Shares, or Sell Losing Shares and Give Away the Resulting Cash. If you want to make gifts to some favorite relatives and/or charities, they can be made in conjunction with an overall revamping of your taxable (non-IRA) stock and equity mutual fund portfolios. Gifts should be made according to the following tax-smart principles.

Gifts to Relatives. Don’t give away losing shares (currently worth less than what you paid for them). Instead, you should sell the shares and book the resulting tax-saving capital loss. Then, you can give the sales proceeds to your relative.

On the other hand, you should give away winning shares to relatives. It's somewhat likely they will pay lower tax rates than you would pay if you sold the same shares. As explained earlier, relatives in the 0% federal income tax bracket for LTCGs and qualified dividends will pay a 0% federal tax rate on gains from shares that were held for over a year before being sold. (For purposes of meeting the more-than-one-year rule for gifted shares, you can count your ownership period plus the gift recipient’s ownership period.) Even if the winning shares have been held for a year or less before being sold, your relative will probably pay a much lower tax rate on the gain than you would.

Gifts to Charities. The principles for tax-smart gifts to relatives also apply to donations to IRS-approved charities. You should sell losing shares and benefit from the resulting tax-saving capital losses. Then, you can give the sales proceeds to favored charities and claim the resulting tax-saving charitable deductions (assuming you itemize). Following this strategy delivers a double tax benefit: tax-saving capital losses plus tax-saving charitable donation deductions.

On the other hand, you should donate winning shares instead of giving away cash. Why? Because donations of publicly traded shares that you have owned for over a year result in charitable deductions equal to the full current market value of the shares at the time of the gift (assuming you itemize). Plus, when you donate winning shares, you escape any capital gains taxes on those shares. This makes this idea another double tax-saver: you avoid capital gains taxes, while getting a tax-saving donation deduction (assuming you itemize). Meanwhile, the tax-exempt charitable organization can sell the donated shares without owing anything to the IRS.

Finally, if you're over age 70-1/2, you are subject to annual required minimum distributions (RMD) on your traditional IRA accounts. Consider making a direct contribution from your IRA to your favorite charity for any amount and it applies towards your annual RMD obligation. That way, the income is never taxed, and reduces your overall AGI, which can benefit you in many ways (e.g., possibly lower medicare premiums, less taxation of social security benefits, less exposure to deduction phaseouts that are based on your AGI).

Convert Traditional IRAs into Roth Accounts. The best profile for the Roth conversion strategy is when you expect to be in the same or higher tax bracket during your retirement years. The current tax hit from a conversion done this year may turn out to be a relatively small price to pay for completely avoiding potentially higher future tax rates on the account’s earnings.

A few years ago, the Roth conversion privilege was a restricted deal. It was only available if your modified AGI was $100,000 or less. That restriction is gone. Even billionaires can now do Roth conversions! If you have a lower than normal maximum tax bracket, you may want to consider a Roth conversion before year end.

Take Advantage of Principal Residence Gain Exclusion Break. Home prices are on the upswing in many areas. More good news: Gains of up to $500,000 on the sale of a principal residence are completely federal-income-tax-free for qualifying married couples who file joint returns. $250,000 is the gain exclusion limit for qualifying unmarried individuals and married individuals who file separate returns. To qualify for the gain exclusion break, you normally must have owned and used the home as your principal residence for a total of at least two years during the five-year period ending on the sale date. You’ll definitely want to take these rules into consideration if you’re planning on selling your home in today’s improving real estate environment.

Watch out for the AMT. The TCJA significantly reduced the odds that you will owe AMT for 2018 by significantly increasing the AMT exemption amounts and the income levels at which those exemptions are phased out. Even if you still owe AMT, you will probably owe considerably less than under prior law. Nevertheless, it’s still critical to evaluate year-end tax planning strategies in light of the AMT rules. Because the AMT rules are complicated, you may want some assistance. We can help.

Don’t Overlook Estate Planning. The unified federal estate and gift tax exemption for 2018 is a historically huge $11.18 million, or effectively $22.36 million for married couples. Even though these big exemptions may mean you are not currently exposed to the federal estate tax, your estate plan may need updating to reflect the current tax rules. Also, you may need to make some changes for reasons that have nothing to do with taxes, especially if your estate plan is more than a few years old. Don't put off this very important life planning task.

Year-end Planning Moves for Small Businesses

Establish a Tax-favored Retirement Plan. If your business doesn’t already have a retirement plan, now might be the time to take the plunge. Current retirement plan rules allow for significant deductible contributions. For example, if you are self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $55,000 for 2018. If you are employed by your own corporation, up to 25% of your salary can be contributed with a maximum contribution of $55,000.

Other small business retirement plan options include the 401(k) plan (which can be set up for just one person), the defined benefit pension plan, and the SIMPLE-IRA. Depending on your circumstances, these other types of plans may allow bigger deductible contributions.

The deadline for setting up a SEP-IRA for a sole proprietorship, and making the initial deductible contribution for the 2018 tax year, is 10/15/2019 if you extend your 2018 return to that date. Other types of plans generally must be established by 12/31/2018 if you want to make a deductible contribution for the 2018 tax year, but the deadline for the contribution itself is the extended due date of your 2018 return. However, to make a SIMPLE-IRA contribution for 2018, you must have set up the plan by October 1. So, you might have to wait until next year if the SIMPLE-IRA option is appealing.

Contact us for more information on small business retirement plan alternatives, and be aware that if your business has employees, you may have to cover them too.

Take Advantage of Liberalized Depreciation Tax Breaks. Thanks to the TCJA, 100% first-year bonus depreciation is available for qualified new and used property that is acquired and placed in service in calendar year 2018. That means your business might be able to write off the entire cost of some or all of your 2018 asset additions on this year’s return. So, consider making additional acquisitions between now and year-end. Contact us for details on the 100% bonus depreciation break and what types of assets qualify.

Claim 100% Bonus Depreciation for Heavy SUVs, Pickups, or Vans. The 100% bonus depreciation provision can have a hugely beneficial impact on first-year depreciation deductions for new and used heavy vehicles used over 50% for business. That’s because heavy SUVs, pickups, and vans are treated for tax purposes as transportation equipment that qualifies for 100% bonus depreciation. However, 100% bonus depreciation is only available when the SUV, pickup, or van has a manufacturer’s Gross Vehicle Weight Rating (GVWR) above 6,000 pounds. The GVWR of a vehicle can be verified by looking at the manufacturer’s label, which is usually found on the inside edge of the driver’s side door where the door hinges meet the frame. If you are considering buying an eligible vehicle, doing so and placing it in service before the end of this tax year could deliver a juicy write-off on this year’s return.

Claim Bigger First-year Depreciation Deductions for Cars, Light Trucks, and Light Vans. For both new and used passenger vehicles (meaning cars and light trucks and vans) that are acquired and placed in service in 2018 and used over 50% for business, the TCJA dramatically increased the so-called luxury auto depreciation limitations. For passenger vehicles that are acquired and placed in service in 2018, the luxury auto depreciation limits are as follows:

· $18,000 for Year 1 if bonus depreciation is claimed.

· $16,000 for Year 2.

· $9,600 for Year 3.

· $5,760 for Year 4 and thereafter until the vehicle is fully depreciated.

These allowances are much more generous than under prior law. Note that the $18,000 first-year luxury auto depreciation limit only applies to vehicles that cost $58,000 or more. Vehicles that cost less are depreciated over six tax years using depreciation percentages based on their cost. Contact us for details.

Cash in on More Generous Section 179 Deduction Rules. For qualifying property placed in service in tax years beginning in 2018, the TCJA increased the maximum Section 179 deduction to $1 million (up from $510,000 for tax years beginning in 2017). The Section 179 deduction phase-out threshold amount was increased to $2.5 million (up from $2.03 million). The following additional beneficial changes were also made by the TCJA.

Property Used for Lodging. For property placed in service in tax years beginning in 2018 and beyond, the TCJA removed the prior-law provision that disallowed Section 179 deductions for personal property used predominately to furnish lodging or in connection with the furnishing of lodging. Examples of such property would apparently include furniture, kitchen appliances, lawn mowers, and other equipment used in the living quarters of a lodging facility or in connection with a lodging facility such as a hotel, motel, apartment house, dormitory, or other facility where sleeping accommodations are provided and rented out.

Qualifying Real Property. As under prior law, Section 179 deductions can be claimed for qualifying real property expenditures, up to the maximum annual Section 179 deduction allowance ($1 million for tax years beginning in 2018). There is no separate limit for qualifying real property expenditures, so Section 179 deductions claimed for real property reduce the maximum annual allowance dollar for dollar. Qualifying real property means any improvement to an interior portion of a nonresidential building that is placed in service after the date the building is first placed in service, except for expenditures attributable to the enlargement of the building, any elevator or escalator, or the building’s internal structural framework.

For tax years beginning in 2018 and beyond, the TCJA expanded the definition of real property eligible for the Section 179 deduction to include qualified expenditures for roofs, HVAC equipment, fire protection and alarm systems, and security systems for nonresidential real property. To qualify, these items must be placed in service in tax years beginning after 2017 and after the nonresidential building has been placed in service.

Time Business Income and Deductions for Tax Savings. If you conduct your business using a pass-through entity (sole proprietorship, S corporation, LLC, or partnership), your shares of the business’s income and deductions are passed through to you and taxed at your personal rates. Assuming the current tax rules will still apply in 2019, next year’s individual federal income tax rate brackets will be the same as this year’s (with modest bumps for inflation). In that case, the traditional strategy of deferring income into next year while accelerating deductible expenditures into this year makes sense if you expect to be in the same or lower tax bracket next year. Deferring income and accelerating deductions will, at a minimum, postpone part of your tax bill from 2018 until 2019.

On the other hand, if you expect to be in a higher tax bracket in 2019, take the opposite approach. Accelerate income into this year (if possible) and postpone deductible expenditures until 2019. That way, more income will be taxed at this year’s lower rate instead of next year’s higher rate. Contact us for more information on timing strategies.

Maximize the New Deduction for Pass-through Business Income. The new deduction based on Qualified Business Income (QBI) from pass-through entities was a key element of the TCJA. For tax years beginning in 2018–2025, the deduction can be up to 20% of a pass-through entity owner’s QBI, subject to restrictions that can apply at higher income levels and another restriction based on the owner’s taxable income. The QBI deduction also can be claimed for up to 20% of income from qualified REIT dividends and 20% of qualified income from publicly-traded partnerships.

For QBI deduction purposes, pass-through entities are defined as sole proprietorships, single-member LLCs that are treated as sole proprietorships for tax purposes, partnerships, LLCs that are treated as partnerships for tax purposes, and S corporations. The QBI deduction is only available to non-corporate taxpayers (individuals, trusts, and estates).

Because of the various limitations on the QBI deduction, tax planning moves (or non-moves) can have the side effect of increasing or decreasing your allowable QBI deduction. So, individuals who can benefit from the deduction must be really careful at year-end tax planning time. We can help you put together strategies that give you the best overall tax results for the year.

Claim 100% Gain Exclusion for Qualified Small Business Stock. There is a 100% federal income tax gain exclusion privilege for eligible sales of Qualified Small Business Corporation (QSBC) stock that was acquired after 9/27/10. QSBC shares must be held for more than five years to be eligible for the gain exclusion break. Contact us if you think you own stock that could qualify.

Conclusion

This post only covers some of the year-end tax planning moves that could potentially benefit you and your business. Please contact us if you have questions, want more information, or would like us to help in designing a year-end planning package that delivers the best tax results for your particular circumstances.